Following a $7.3MM loss for the fiscal year ended June 30, 2020, Bank of The Bahamas Limited (the Bank) rebounded with a $2.37MM profit for the first quarter ended September 30, 2020 according to the Bank’s Executives.

Reporting at the Bank’s recent Annual General Meeting, CFO Jihanne Hosmillo-Williams said, after enjoying two consecutive years of profitability, the Bank’s net loss for the year ended June 30, 2020 stemmed from loan loss provisioning due to COVID-19 related impacts such as the downgrade of the country’s credit rating, a significant increase in the unemployment rate and reduction in forecasted GDP. However, she said BOB is now back to net income of $2.37MM at the end of its first quarter fiscal 2021, with capital and liquid asset ratios well above required levels.

“Total revenues for this period continue to be consistent with the prior year, although noted are some minimal decreases in fees and commission income, directly attributable to a certain level of decreased business volumes and transactions due to the current environment under COVID-19,” Mrs. Hosmillo-Williams said. She stated that the Bank’s balance sheet also continues to be strong with total assets increasing from $822MM as at June 30, 2020 to $874MM as at September 30, 2020.

“Loans and advances to customers, which account for more than 40% of our total assets, continued to increase, as well as our cash and cash equivalents. Our total liabilities, primarily Customer deposits, also showed a significant increase since June 30, 2020, so this continued to show a strong balance sheet position for the Bank,” she said.

With the continuing effects of the pandemic on the economy and uncertainty concerning the return to full recovery, Wayne Aranha, Chairman, Bank of The Bahamas Limited, said it would be difficult to speak with any degree of confidence about the Bank’s prospects for fiscal year 2021.

“Costs will have to be closely managed in an environment where top line growth is limited. We are undoubtedly operating in a more challenging environment, and this will require strong portfolio management and resourcefulness in developing new sources of income,” Mr. Aranha said.

Kenrick Brathwaite, Managing Director, Bank of The Bahamas Limited, said fiscal 2020 was a year of firsts including a category 5 hurricane and a global pandemic that challenged and strengthened the Bank. He said the global pandemic required that the institution adjust and adapt quickly to new health protocols and new ways of working including remote work and virtual meetings, even as it introduced financial initiatives to assist customers who were adversely impacted.

Despite the pandemic’s impact on the Bahamian economy and the Bank, Mr. Brathwaite said he is encouraged by progress made to ensure that the Bank becomes the most efficient, customer centric bank in The Bahamas. While stating that the Bank’s overall strategy has not changed, he noted that the pandemic has resulted in adjusted completion deadlines for some projects.

“Presently we are still in our initial phase of Strengthening the Foundation which we expect will be completed by May 2021, allowing your Bank to move to phase 2 of Accelerated Growth. We will point out that phase 1 is an aggressive and ambitious plan to address upgrading our core banking system, restructuring of our corporate organization, updating of our policies and procedures, implementation of succession plans and automation of most of our procedures.

“Additionally, we expect to address our desire to enhance our online platform, improve our website and embark on a digital expansion to facilitate our ability to reach the persons on the Family Islands, especially those unbanked potential customers,” he said.

Elaborating on the Bank’s plans for expanding services into the Family Islands, Wayne Aranha, Chairman, Bank of The Bahamas said the Bank is looking at providing products and services in a way that may not necessarily require setting up branches so the Bank would be able to service communities without harming its shareholders.

As BOB moves into Phase 2 of its Strategic Plan during the fourth quarter of fiscal 2021, the Bank expects to address its list of products, inclusive of debit cards and an enhanced Merchant Services Department.

“During this phase we will observe a more accelerated advancement to a state of sustained profitability as we align our growth strategy with our products and services…we remain strong and resilient and despite the challenges, we are on the path to success,” Mr. Brathwaite said.

During the Annual General Meeting the following persons were elected as Directors of the Board for the ensuing year: Mr. Wayne Aranha, Mr. Timothy Brown, Mr. Kirk Antoni, Mrs. Margo Hillhouse, Mr. Whitney Patton, Mrs. La Verne Deleveaux and Dr. Dana Hall.

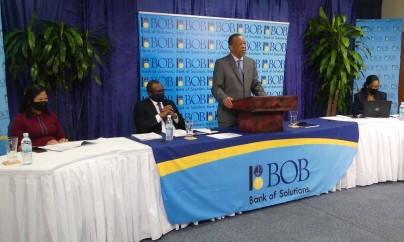

Photo Caption

BOB VIRTUAL AGM – Chairman Wayne Aranha addresses shareholders at Bank of The Bahamas Limited’s recent AGM. Seated from left are: Jihanne Hosmillio-Williams, Chief Financial Officer, BOB; Kenrick Brathwaite, Managing Director, BOB; and Laura Williams, Manager, Corporate Affairs, BOB.

Unlock More from Your Everyday Banking